Wall Street thinks Trump's tariffs will eat Main Street alive

Sometimes, the stock market is the economy.

It’s hard to think of any occasion when America dealt itself such a self-inflicted economic wound.

Silver Bulletin wasn’t around for the Smoot-Hawley tariffs of 1930, which helped to catalyze the Great Depression. But the tariffs that President Trump announced just after markets closed on Wednesday, which triggered the fifth-largest point drop in the history of the Dow Jones Industrial Average on Thursday — with further massive losses underway today — are bigger than Smoot-Hawley.

And they’re even more capricious, based on a formula — possibly derived through ChatGPT! — which simply takes the ratio of our trade deficit to our imports from each country and has little to do with tariffs.

Take, for example, Vietnam — a key partner for the United States in containing Chinese aggression, given that it has long had among the frostiest relationships with China in the region.1 It will now be tariffed at 46 percent. That’s not because Vietnam’s tariffs on American imports are particularly significant — 8.1 percent on non-agricultural products — but rather because we import all sorts of cheap stuff like clothing, toys, and electrical equipment from them. In contrast, Vietnam, growing but still relatively impoverished, isn’t a particularly big consumer of American-made goods.

In percentage terms — which is the better way to look at this — the drop in the markets wasn‘t quite so bad: a mere 3.98 percentage point loss in the Dow on Thursday, and 4.84 points in the broader S&P 500. Still, even though Trump had announced “Liberation Day” in advance, Wall Street has persistently failed to take Trump’s tariff threats seriously enough: Thursday’s declines were on top of the downward adjustments stocks already made after the Canada-Mexico tariffs, the auto tariffs Trump announced last week, and whatever expectations for “Liberation Day” were already priced into the market.

But make no mistake: Having finally realized the scope of the problem, Wall Street thinks these tariffs, which are already being reciprocated by China and other countries, will cause massive pain for American consumers and businesses.

The stock market tells us a lot

As a pro-markets liberal, I’ve long been consistent about saying that the stock market does tell you something — often quite a lot — about the economy. That’s partly because I’ve actually done some work in economic forecasting. Our election model includes an economic index, which has both a current and forward-looking component. (We’re working to create a version of the economic index that publishes on a permanent basis.) Even if you account for other major variables like inflation and jobs, changes in stock market prices have predictive power for forecasting broader trends in the economy, not just corporate profits.

Trump-supporting sycophants in Silicon Valley — I’m sorry to use such invective; it’s really not my style, but I don’t think a softer term is precise enough — are either lying to you or lying to themselves about this. Here’s Shaun Maguire, a partner at Sequoia Capital, which was once one of the most prestigious VC firms in the Valley but whose reputation has suffered after investments in Sam Bankman-Fried and other miscalculations:

OK, Shaun, did you actually look at stocks? Which ones suffered the biggest losses? Because I did. And they’re largely consumer staples from the lower-middlebrow on up, or cyclical purchases — like autos and air travel — that Americans consume more of when they think good times are ahead and pull back from when they’re in the brace position preparing for a recession.

The stock market is predicting a grim near-term future

Here’s a list I pulled together of 80 or so stocks and how they performed on Thursday. It’s a curated list — I’ve focused mostly on the biggest losers, the biggest gainers (there were a few gainers), the biggest stocks by market capitalization, and some of the most recognizable names — while trying to provide a cross-section that gives you a flavor for how different sectors of the economy performed:

The biggest loser of all was Restoration Hardware (RH), the upscale home decor and furniture retailer. Its stock lost more than 40 percent of its value yesterday, which literally prompted its CEO to say “oh shit” on an earnings call.

This reflects a perfect storm of factors. First, RH severely missed its earnings targets, so it was going to suffer regardless of the tariff announcement. Second, it relies heavily on imports, including from some of the most-tariffed countries. And third, it’s the sort of store you go to when you’re feeling flush: you can always buy a cheaper couch2 or hold onto your old one. Nobody really needs anything they buy from Restoration Hardware.

There are some other analogies to this. Apple was off 9.3 percent, for instance — although a cellphone is a necessity these days, people can hold on to their existing phones longer or transition to discount options.

But scroll down the list, and you’ll also find plenty of brands that are targeted at lower-to middle-income consumers. VF Corporation — an apparel company with subsidiaries like Vans, The North Face and Timberland — was the second-biggest decliner at 28.7 percent. Five Below, a discount store that you’ll often find in strip malls, had the third-biggest drop at 27.8 percent. Now imagine the stores you’d find across the parking lot. Best Buy (-17.8) fell substantially, as did The Gap (-20.3). And so did Dollar General (-13.3 percent), though Dollar Tree gained ground (+4.7).

For retailers, these price movements are sensitive to supply chains — what share of their goods are produced domestically, and to a lesser extent, how much monopsony power they have to squeeze their suppliers. But the changes also reflect the expectation that Americans will cycle down to cheaper goods. Target (-11.5), with its slightly more upscale price points, was down more than Walmart (-2.8), while Costco (+0.2) was up a fraction of a point.

You can find similar patterns in restaurant stocks. I’d joked the other day — actually, I’m not sure it was a joke — that the upmarket salad chain Sweetgreen introducing fries to its menu felt recessionary, just because it has such a health-conscious image. On Thursday, its stock was down 11.9 percent. If you’re worried about the economy, you can probably do better than spending $17 on a fancy salad and still feeling hungry afterward. I’d almost tweeted something similar earlier this week when I saw Starbucks was reintroducing free refills. How did it fare? SBUX stock was down 11.2 percent yesterday.

But McDonald’s stock was up 2.2 percent. Yum! Brands — you know, the company that brings you those combination Taco Bells and Pizza Huts — was up 2.0 percent. There are fewer Frappuccinos in America’s future, but more Doritos Locos Tacos, I guess.

Doordash was off 8.1 percent, but stocks reflecting cheaper foodstuffs that Americans can prepare at home did well: General Mills gained 3 percent, for instance.

Some of this is pretty grim, honestly. Some of the hardest-hit stocks were toy manufacturers, which of course rely on cheap imports. Mattel’s stock declined 16.6 percent, and Hasbro dropped 12.3 percent. But booze (Anheuser-Busch InBev, +1.2 percent) and cigarettes (Philip Morris, +3.9 percent) fared well. (Guess what little Johnny is getting for Christmas.) But all those Big Macs and 6-packs of Bud Light will take a toll. One of the biggest winners on Thursday was Molina Healthcare (+7.5 percent), a managed care company mostly targeted at lower-income consumers.

Even some of the seeming success stories come with asterisks. Goodyear was the biggest gainer on Thursday, up 11.7 percent (though it’s given up some of those gains today). That’s partly because it mostly uses domestic rubber suppliers. But it’s also because more than 80 percent of Goodyear’s tire sales come from replacement tires. You go to Goodyear because you’re hoping to another good year or two out of your existing vehicle because you don’t think it’s prudent to buy a new car.

Some unsympathetic stocks in the financial sector did suffer: Goldman Sachs shares fell by 9.2 percent. The Bank of China’s stock was up by 1.3 percent, however.

I could go on, but you can detect the general pattern. All airline stocks suffered significantly, but the more downscale Southwest (-8.2 percent) held up better than Delta (-10.7 percent) or United (-15.6 percent). Six Flags, the amusement park chain, was down 14.4 percent, but Americans may compensate for their missed vacations by curling up and watching Netflix, which beat the broader market by only declining 2 percent.

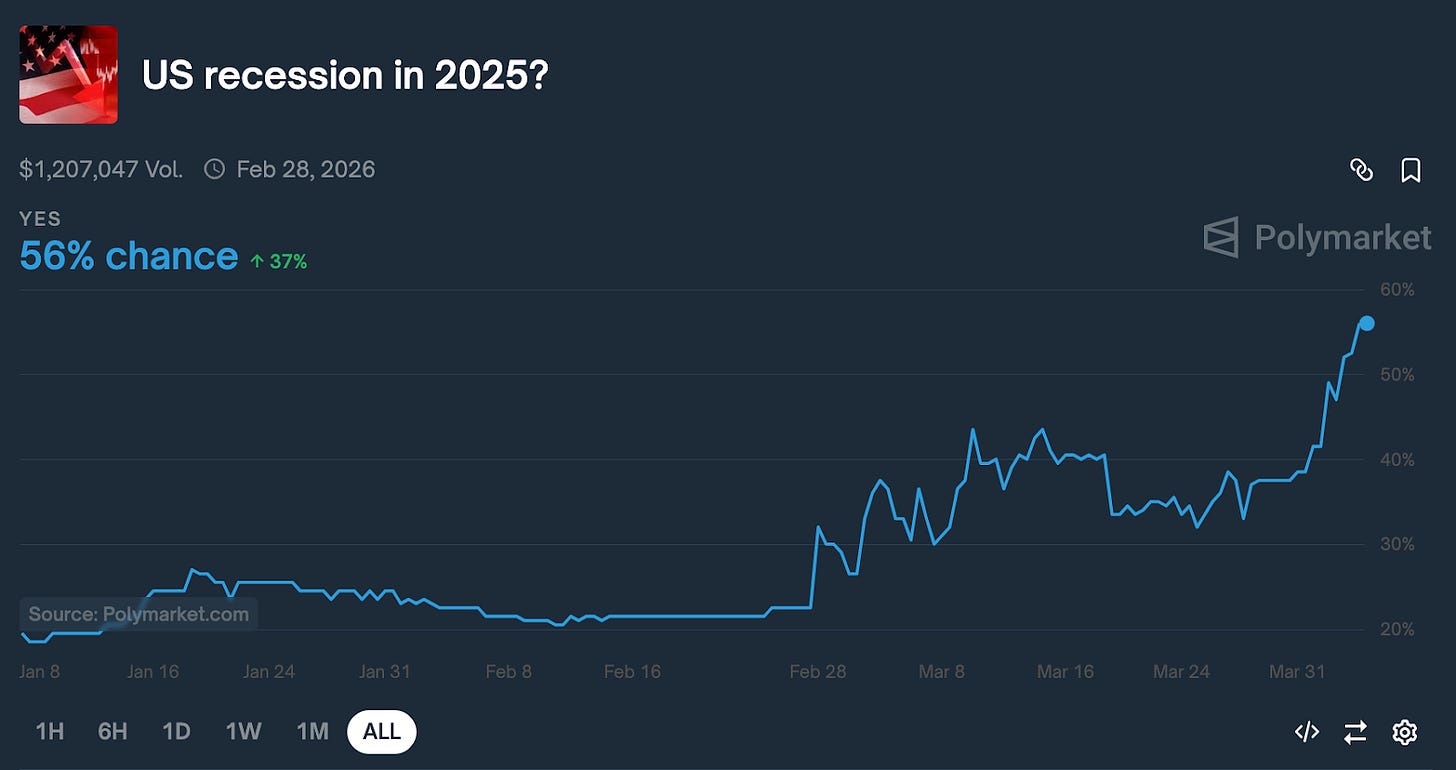

There are also more direct ways to bet on a recession, such as at prediction markets. At Polymarket3, the probability of a US recession in 2025, which was 20 percent at the start of the year, has now shot up to 56 percent:

I won’t attempt to predict whether that number is too high or too low. The bull case is that the economy is notably resilient — GDP dropped by almost 2 trillion dollars in a single quarter during COVID, but the economy quickly returned to trend (though I’m not sure the country ever fully healed in other ways from the pandemic). But the bear case is really quite bearish — that investors are still struggling to come to grips with America’s abdication of economic, diplomatic and cultural leadership and that it will take years to repair the damage, if we ever can.

Congress can fight back, if it has the guts

I’m sure I’ll have more to say about all of this. But the last thing I’d note for now is that Americans aren’t completely helpless to Trump’s whims. Congress could revoke Trump’s tariffs, which override the spirit of the Constitution, which grants Congress the power to levy tariffs. (And in some cases, possibly the letter of the law — there are court challenges underway.) Having delegated many of its responsibilities to the executive over the years, Congress will now need two-thirds majorities to overcome an inevitable veto and get them back, and that isn’t likely. But there was some progress earlier this week when four Republicans joined Democrats in a Senate resolution to reject Trump’s tariffs on Canada.

And if Wall Street is right and we get to the point where Americans are stocking up on booze and cigarettes but avoiding buying new toys or taking their kids to Six Flags — and don’t even dream of upgrading their cars or their homes — and all of this is because of some back-office employee who used ChatGPT to upend the global trade system … look I don’t know what the bottom is in Trump’s approval ratings. But it will be tested in a way it probably never was during the first term. There’s no constituency for this, and the excuses you’re seeing from Silicon Valley are transparent cope. Trump just basically has to hope that Wall Street is wrong, or that the economy, which was pretty good when he took office, has enough gas in the tank to ride it out.

Vietnamese Americans also happen to be among the most Republican-voting immigrant groups.

IKEA would have made for an interesting comparison, but it’s privately held.

I’m a part-time advisor to Polymarket.

To oversimplify, I see three possible outcomes, I don't know which one is most likely.

1) Trump takes back some of the tariffs, claims that Vietnam or Spain or whoever "totally surrendered" after some B.S. symbolic concession, and things somewhat recover. His supporters brag about how Trump totally owned everyone, which is annoying, but they are 45% of the country so they also somewhat get to create their own reality.

2) Some of these countries actually do come to the table, though honestly I'm not sure what a lot of them are supposed to do since the "retaliation" is based on imaginary tariffs and not actual tariffs that can be lowered. Probably a middle case in terms of economic effect, where we have a completely unnecessary slowdown, but not necessarily a recession or an apocalypse.

3) The "humpty dumpty" scenario. Even if everyone finally realizes how dumb this is in 3-6 months, it's way too late to put the pieces of the global trade system back together, and we see a serious global recession. And frankly, a possible complete reordering of the global system. Bonus points if this initial stress causes a black swan event elsewhere in the economy that leads to cascading failure.

The Russia Hoax is being completely diluted. Zero tariffs on….. Russia ! Really !